Fundamental Concepts and Tools of Managerial Economics

Managerial economics integrates economic theory with business practices, focusing on tools like supply and demand, profit analysis, and present value to optimize decision-making and strategy.

1.1 Definition and Scope of Managerial Economics

Managerial economics is the application of economic principles and analytical tools to assist managers in making informed, profit-maximizing decisions. It combines economic theory with practical business strategies, focusing on resource optimization, cost analysis, and market dynamics. The scope of managerial economics extends to understanding consumer behavior, production processes, and competitive markets. It equips managers with frameworks to evaluate risks, allocate resources, and formulate strategies for sustainable growth. By integrating microeconomic concepts, such as supply and demand, into real-world business challenges, managerial economics provides a foundational approach for achieving organizational goals and enhancing competitive advantage in diverse market environments.

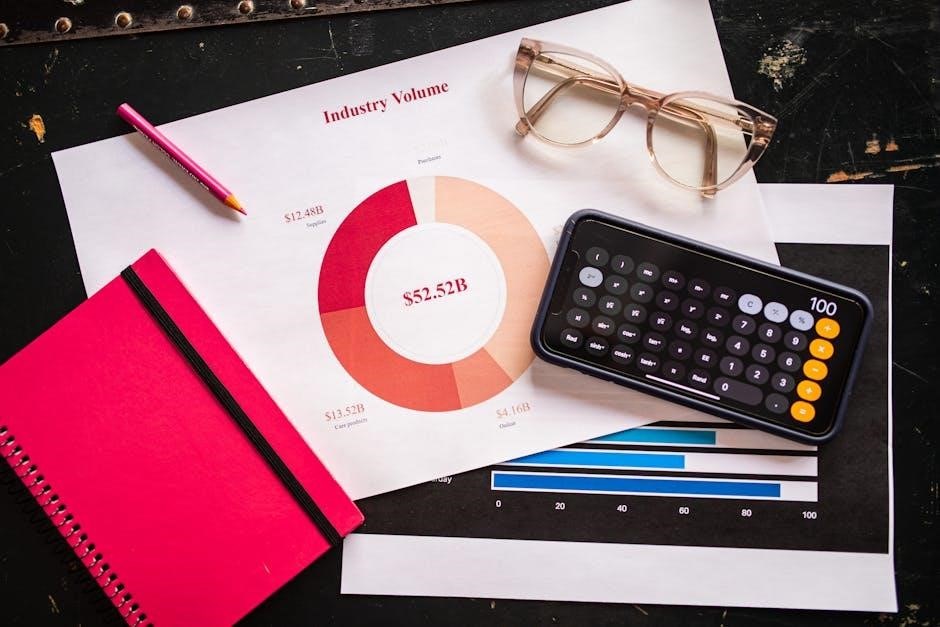

1.2 Essential Economic Tools: Supply and Demand, Profit Analysis, and Present Value

Managerial economics relies on fundamental tools such as supply and demand analysis, profit maximization techniques, and present value calculations. Supply and demand frameworks help businesses understand market dynamics and price determination. Profit analysis enables firms to evaluate financial performance and make cost-effective decisions. Present value calculations are crucial for assessing long-term investments, ensuring resources are allocated efficiently. These tools collectively provide a robust framework for strategic decision-making, allowing managers to optimize profitability, manage risks, and achieve sustainable growth in competitive markets. By mastering these concepts, businesses can enhance their strategic planning and operational efficiency, driving long-term success and stakeholder value.

1.3 The Role of Managerial Economics in Business Strategy

Managerial economics plays a pivotal role in shaping business strategy by integrating economic principles with organizational decision-making. It provides frameworks for identifying goals, analyzing constraints, and optimizing resource allocation. By applying tools like supply and demand analysis, profit maximization, and present value calculations, firms can make informed decisions that enhance profitability and sustainability. Managerial economics also guides strategic planning by evaluating market trends, competitive dynamics, and investment opportunities. Its practical application ensures that businesses can adapt to changing environments, balance short-term gains with long-term objectives, and maintain a competitive edge in the marketplace. This integration of theory and practice is essential for driving growth and resilience in modern enterprises.

Strategic Decision-Making in Business

Strategic decision-making in business involves aligning goals with economic principles to optimize profitability and sustainability, ensuring informed choices that balance short-term gains with long-term organizational objectives effectively.

2.1 Goal Setting and Constraints in Managerial Economics

Goal setting in managerial economics involves defining clear, measurable objectives aligned with organizational aims. Constraints, such as limited resources, market conditions, and regulatory requirements, influence these goals. Identifying and analyzing constraints enables firms to allocate resources efficiently and make informed decisions. Economic tools like present value analysis and cost-benefit evaluations help prioritize objectives. Effective goal setting balances profitability with sustainability, ensuring long-term success. Constraints shape strategic choices, driving innovation and adaptability in competitive markets. Understanding these dynamics is crucial for aligning business strategies with economic realities, optimizing outcomes, and achieving sustainable growth in diverse market environments.

2.2 The Importance of Profits in Business Strategy

Profits are the core driver of business sustainability and growth, reflecting efficient resource allocation and value creation. They enable firms to invest in innovation, expand operations, and reward stakeholders. In strategic decision-making, profit maximization guides pricing, output, and market entry strategies. Economic profits, beyond accounting measures, indicate competitive advantage and long-term viability. Profits also signal market effectiveness and organizational health, influencing stakeholder confidence and attracting investment. Managing profitability through economic tools ensures alignment with strategic objectives, fostering resilience and adaptability in dynamic markets. Thus, profits are essential for achieving and sustaining competitive success in business strategy and managerial economics.

2.3 Economic vs. Accounting Profits: Key Differences

Economic profits differ from accounting profits by considering both explicit and implicit costs, including opportunity costs. Accounting profits focus on actual revenues and expenses, while economic profits assess the net gain from all resources used. This distinction is vital for strategic decisions, as economic profits reveal whether resources are allocated efficiently. For instance, a business may show accounting profits but incur economic losses if alternative uses of resources yield higher returns. Understanding this difference helps firms evaluate profitability more accurately and align decisions with long-term sustainability and competitive advantage in managerial economics and business strategy.

Game Theory and Industrial Organization

Game theory explores strategic decision-making among competitors, while industrial organization analyzes market structures like perfect competition and monopoly, shaping business strategies and economic outcomes effectively.

Game theory is a fundamental tool in managerial economics, enabling businesses to analyze strategic interactions among competitors. It provides frameworks to predict outcomes of decisions, helping firms anticipate rivals’ actions and optimize their strategies. By modeling competitive scenarios, such as oligopolies or auctions, game theory aids in identifying optimal pricing, production, and market-entry strategies. Its principles, like Nash equilibrium, reveal how rational decision-making can lead to mutually beneficial or detrimental outcomes. Businesses apply game theory to enhance negotiation tactics, allocate resources effectively, and formulate sustainable competitive advantages. This analytical approach ensures informed decision-making in dynamic and uncertain market environments, aligning with broader business objectives.

3.2 Market Structures: Perfect Competition, Monopoly, and Monopolistic Competition

Market structures like perfect competition, monopoly, and monopolistic competition shape business strategies. Perfect competition involves many firms producing identical goods, driving prices to marginal cost. Monopoly, with a single seller, allows price-setting but stifles innovation. Monopolistic competition balances competition with product differentiation. Understanding these structures helps businesses formulate pricing, production, and differentiation strategies to maximize profitability and sustainability, aligning with managerial economics principles to optimize market positioning and competitive advantage.

Managerial Economics in Practice

Managerial economics applies economic concepts to real-world business challenges, using case studies and behavioral insights for informed decision-making, enhancing profitability, and optimizing resource allocation in competitive markets.

4.1 Case Studies: Real-World Applications of Managerial Economics

Case studies demonstrate how managerial economics solves real-world business challenges. For instance, companies like Amcott and Clorox use economic tools to address losses and develop marketing strategies. These examples highlight how firms apply supply and demand analysis, cost-benefit trade-offs, and behavioral economics to optimize decisions; By analyzing market demand, input costs, and competitive dynamics, businesses can formulate strategies to enhance profitability and sustainability. Such practical applications showcase the effectiveness of managerial economics in addressing diverse industry challenges, from pricing strategies to resource allocation, ensuring firms remain competitive in dynamic markets. These case studies provide actionable insights for managers to improve decision-making processes and achieve organizational goals effectively.

4.2 Behavioral Economics and Its Impact on Business Decisions

Behavioral economics explores how psychological, social, and emotional factors influence decision-making, departing from traditional economic assumptions of rationality. It reveals that individuals often make irrational choices, affected by biases like anchoring or framing. Businesses leverage these insights to design strategies that “nudge” consumer behavior, such as through pricing strategies or default options. For instance, companies use loss aversion to frame promotions, enhancing demand. This field also informs organizational decisions, helping managers understand employee motivations and improve incentive structures. By integrating behavioral economics, firms can craft more effective marketing campaigns, pricing models, and policy interventions, ultimately driving better outcomes in complex, real-world markets.

Global Perspectives and Future Trends

Managerial economics plays a crucial role in navigating globalization, enabling businesses to adapt to international markets and emerging trends like big data and artificial intelligence in strategy.

5.1 Managerial Economics in International Business

Managerial economics is vital in international business, guiding firms through global market dynamics, exchange rates, and cross-border strategies. It helps companies optimize resource allocation and pricing tactics to maximize profitability in diverse economic environments. By analyzing market structures and competitive landscapes globally, businesses can make informed decisions on entry strategies, partnerships, and risk management. The application of economic principles, such as comparative advantage and trade theories, enables firms to thrive in multinational settings; This ensures sustainable growth and competitive advantage in an increasingly interconnected global economy, where adaptability and strategic planning are essential.

5.2 Emerging Trends in Business Strategy and Economic Analysis

Emerging trends in business strategy and economic analysis emphasize the integration of behavioral economics, big data, and artificial intelligence to enhance decision-making. Companies are increasingly adopting sustainability and ESG (Environmental, Social, Governance) factors into their strategic frameworks. The rise of digital platforms and global supply chain dynamics necessitate adaptive strategies and resilient business models. Additionally, advancements in predictive analytics and machine learning enable firms to forecast market trends more accurately. These trends underscore the importance of combining economic principles with innovative tools to drive competitive advantage and long-term growth in a rapidly evolving global business landscape.